This article is all about what is HRA in your salary and its tax benefits, including details on how to calculate the HRA exemption, what important documents you require to claim HRA deduction, important precautions you need to take etc.

What is HRA in salary? Full Form of HRA and meaning

Full form of HRA is House Rent Allowance. It is an allowance paid by your employer for your house rent expenses which is eligible for a tax benefit under Section 10(13A) of Income Tax Act, 1961. Usually, employers keep the HRA amount at 50% of Basic Salary.

If you pay rent for your accommodation, you can save tax on this allowance.

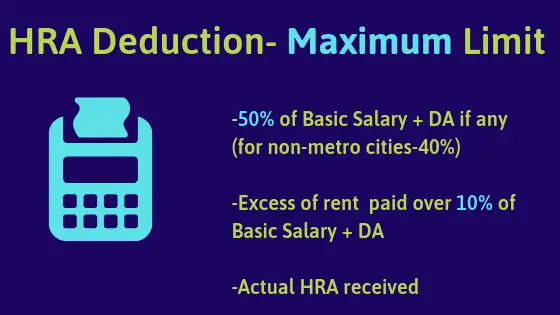

The amount of tax exemption is subject to a limit which depends on the following points:

- Amount of your basic salary (Including Dearness Allowance + % Commission if any)

- Monthly rent amount

- Location of residential accommodation (in metro city or others) .

You need to follow the proper procedures in this regard to claim this tax exemption.

Your employer will also require you to submit necessary documents to consider this tax benefit while deducting TDS from your salary.

What is the tax exemption available on HRA?

Tax Exemption is available on House Rent Allowance under Section 10 (13 A) of the Income Tax Act, 1961

House Rent Allowance can help you save a decent amount of tax.

Consider this – You can save tax of more than Rs. 4,000/- per month, on a monthly HRA of Rs. 30,000/- and rent payment of Rs. 20,000/- (if you are in 30% income tax bracket)

As per Indian Income tax law, amount of HRA that can be tax free will be minimum of the below three amounts:

- 50% of Basic Salary * (if the rental accommodation is in a metro city i.e. Mumbai, Delhi, Kolkata, Chennai). For non-metro cities, the limit is 40%.

- Excess of the rent paid over 10% of Basic Salary

- Actual amount of HRA received (will be applicable if any of above two amounts exceed HRA actually received)

Note: Basic Salary to include Dearness Allowance (DA) and commission as % of turnover, if any.

Example on how to calculate tax benefit

Here is an easy example to understand the tax benefit you can make:

- Monthly Basic Salary – Rs. 65,000/-

- Monthly HRA received – Rs. 30,000/-

- Monthly Rent paid – Rs. 20,000/-

Rental accommodation is in Mumbai.

The exempted amount per month will be minimum of:

- 50% of Basic salary i.e. Rs. 65,000/- = Rs.32,500/-

- Rent paid – 10% of basic i.e. Rs. 20,000/- Less Rs.6500 (Rs.65,000 * 10%) = Rs. 13,500/-

- Actual HRA received i.e. Rs. 30,000/-

The exempted amount will be the minimum of the above i.e. Rs.13, 500 per month.

Annual exemption will be Rs. 13,500 * 12 months = Rs. 1, 62, 000/-

Annual Tax savings (Assuming you are in 30% bracket) = Rs. 1,62, 000/-*30%= Rs. 48,600/-

That is a monthly saving of more than Rs. 4, 000/- not bad to see your TDS coming down.

HRA Calculator 2019-20

You can refer below link to calculate the eligible amount of HRA Exemption on Income Tax India:

Just enter the details of your Basic Salary, House Rent Allowance Received, Monthly Rent paid etc. to get the break up into taxable and exempt amount.

What are the documents required for claiming HRA exemption (Rent Agreement, Rent Receipt, PAN etc.)

It is not really that complicated to get the HRA exemption if you follow the proper procedures.

You need to have the following documents in place which are usually required from tax perspective.

1. Rent / Lease Agreement

Although not mandatory as per law, most employers insist that the employee provides a rent agreement for getting the HRA tax deduction.

Income Tax Act puts the responsibility on the employer to check the proof of rent payment and the rent agreement is an important document to establish the genuineness of the transaction.

Click here to download free rent agreement template

Usually, the rent agreement is executed on a stamp paper as per the state law. Most rent agreements are executed for a period of 11 months.

This is usually done to avoid stamp duty and registration charges, as registration is mandatory for lease agreement greater than 12 months. (Indian Registration Act, 1908)

2. Rent Receipts as proof of payment

Your employer is required to collect rent receipts as a proof of rent payment.

Rent receipts are not mandatory if the rent payment is less than Rs.3,000/- per month, as per Income Tax Act.

If the rent is paid through cash and amount is more than Rs.5, 000/- , a revenue stamp is required on rent receipts, (as required under Indian Stamp Act, 1899).

There is no need for a revenue stamp if the rent is paid by cheque or banking channel.

Rent Receipt contain the following details:

- Date of receipt

- Name of the tenant

- Amount of rent paid by tenant

- Period for which rent is paid

- Address of the rental accommodation

- Name and Sign of Landlord

- PAN no. of Landlord

3. PAN of landlord

This is required under Income Tax law, if annual rent paid is more than Rs. 1 lakh

HRA exemption rules: What precautions you need to take while claiming HRA deduction?

Make sure you have all the above documents in place.

Also, take care that the rent being paid is genuine and through a banking channel which can be verified.

Another important condition is that you actually stay in this rental accommodation (yes, it is obvious but important)

How to claim HRA deduction when living with parents?

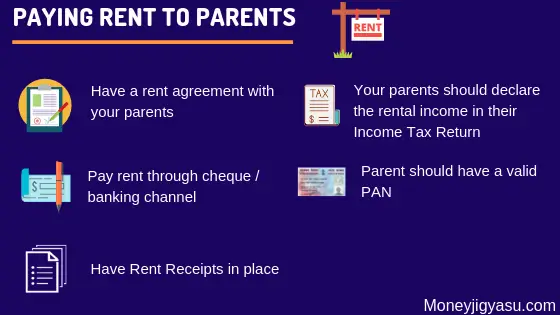

If you pay rent to your parents, make sure you maintain the following discipline:

- Enter into rent agreement with your parents. The agreement is to be entered with your parent who is the owner of the house property. If the property is held jointly, you may pay the rent to both.

- Pay the rent every month through your bank account, as per your agreement

- Make sure your parents have a valid PAN and declare the rental income in their respective Income Tax Return

- You actually stay in the rental accommodation

- Make sure you declare the details of monthly rent paid and the accommodation address to your employer for TDS.

Paying rent to your spouse

While there is no specific provision to reject HRA claims on rent paid to spouse, there are numerous cases where such arrangement has been questioned by tax authorities.

It is not advisable to enter into such arrangement.

It will be really difficult to prove the genuineness of the transaction, given the nature of the relationship.

Can both husband and wife claim HRA exemption?

If both you and your spouse are paying rent to the landlord, then you both can claim HRA deduction for your share in the rent payment.

However, the documents i.e. rent agreement, rent receipts and bank payments should be reflecting the respective rent payments.

You should take care to avoid any duplicate claim for same payment.

Also, check this article which talks about sharing the rent payments between spouse to optimise HRA benefit.

Where to fill HRA in ITR 1 AY 2018-19?

The exempted amount of House Rent Allowance will be shown under Exempt Income and not under the Head salaries as below:

Nature of Income:

Section 10(13A)- House Rent Allowance

Can you claim tax benefit for both HRA and Home Loan together?

The answer is yes, if you stay in a rental accommodation and not in your own house property against which home loan is taken.

This can happen in many situations i.e. if you stay on rent in Mumbai for a job and your own house is in another city i.e. Hyderabad.

If you have put your own house on rent, you can get the full interest on home loan as a loss (without the cap of Rs.2 lakh). But of course, you will have to pay tax on your rental income.

There may be a situation where you have a purchased a house which is under construction. In this case also, you can get the benefit of both HRA and Home loan payment.

What’s important is that there is a genuine situation where you have to stay in a rental property.

Getting a tax deduction on house rent if you do not receive HRA as a part of salary

Even if you don’t receive House Rent Allowance as a part of your salary, there is a provision under Income Tax Act, 1961 to give you the tax benefit.

This benefit is available under section 80GG and is minimum of the following three amount:

- Rs. 5,000/- per month

- 25% of Total Income

- Actual Rent Less 10% of Income

Recent Changes in Law

The Income Tax Dept is keeping a tab on the genuineness of the HRA allowance exemptions, keeping in mind certain fraud claims.

The recent Income Tax Return (ITR) applicable for Financial year 2017-18 requires the landlord to disclose the PAN of the tenant in his ITR.

From June 2016, salaried employees have been declaring the details of the rent payments for HRA deduction along with PAN of landlord in Form 12 BB to their employer.

Your employer needs to submit Form 12 BB to the Income Tax Department.

This makes it very easy for the income tax officials to match your rent payments with the rental income declared by the landlord.

A case where employee claim was rejected

The Income Tax Tribunal rejected the HRA claim of a person showing rent paid to her mother, as she could not produce any evidence such as rent agreement, bank statement, proof of rent payments, electricity/water bill payments through cheque etc.

Also, her mother didn’t disclose the rent income in her tax return.

The ruling gives emphasis to the genuineness of the claims that the income tax department could verify.

If you have any questions, please feel free to put in the comments.

References:

Hi, I am CA with a passion for personal finance and investing. I use this blog to share helpful money gyan that I have learned the hard way.

Please clarify whether exemption in HRA is to be calculated on month to month basis. since during a financial year I was receiving HRA every month but rent is paid for say 8 months only and no rent was paid for the remaining 4 months as I was staying in my own house

You can get the HRA benefit for 8 months in this case.