PE ratio is one of the most popular measures used to evaluate a stock. It is also one of the most hyped and least understood metric.

So what makes reading the PE ratio so important and confusing?

Is it enough to make an investment decision?

Perhaps not.

But the PE ratio can be a really good filter if used with other key metrics. This post gives you all the information you need to read and analyse the PE ratio.

What is PE ratio? How is it calculated?

PE ratio is the ratio of the Market Price of company’s share to its Earning Per Share.

PE Ratio= Market Price/ Earning Per Share (EPS)

Where EPS = Net Income (Net Profit) for the year available to stock holders / Total No. of Shares Outstanding

PE ratio is calculated simply by dividing the Market Price of the Share by its latest annual earnings per share where:

- Market Price is the Closing market price of the share on the previous day and

- Latest Earning Per Share is the EPS of the last twelve months

Since the numerator i.e. market price of stock changes every day, the PE ratio will change daily.

As EPS of the last year i.e. trailing 12 months is used to calculate the PE ratio, it is also called as the Trailing PE ratio.

Since listed companies declare their financial results every quarter, the sum of EPS of the last four quarters is used to calculate the PE ratio.

You can easily check the PE ratio of stock on any stock screener or index website.

Example of PE ratio

If stock is annually earning $5 per share and is trading at a market price of $50, then its PE ratio on that day is 10 (Market Price- $50/ EPS- $5).

What this means is if you pay 50 dollars to buy the share, it will take 10 years for the stock to earn your purchase price. This is assuming there is no increase in earnings per share over this period.

How PE ratio is used for valuation

PE ratio is often used as a valuation measure to determine if the stock is over-valued or under-valued.

It is especially a popular ratio in the value investing circle.

Benjamin Graham in his book “The Intelligent Investor” shares a thumb rule on using PE ratio for stock selection.

He says that:

“Current price should not be more than 15 times average earnings of the past three years. i.e. PE should be less than 15.”

Note that, Benjamin advises you to use average earnings per share and not just the EPS of last year.

This is because many a times, a company may report abnormally high income in a given year which cannot be sustained, thereby giving an impression of attractive low PE.

The purpose behind using Average Earnings per share for the last three years is to even out such abnormal years.

Further, in the book Security Analysis, Benjamin suggests that a PE ratio should not be more than 20 times average earnings as it does not provide adequate margin of safety.

Benjamin Graham used a combination of the Price to Book value (P/B) and PE ratio for valuing a stock. He suggested that multiple of P/B and PE is less than or equal to 22.5. This multiple combines gives a comprehensive picture using Book Value and EPS and is known as Graham’s magic multiple.

How to read if the PE ratio is good to buy?

Most people get confused here.

A single digit PE i.e. less than 10 is often considered to be a bargain.

However, a low PE ratio does not mean the stock is available at a cheap price.

There are many a times a good reason why the PE ratio of stock is low.

This can be due to many reasons like unpredictability of the earnings, doubts over management integrity and future plan, inability to innovate, changes in the industry etc.

Similarly, a high PE ratio does not necessarily mean that stock is expensive as there are situations where the market is expecting a good growth in the Earnings Per Share.

This may be due to many reasons like expected growth in earnings, company may have a moat over its competitors, innovations by the company etc. which enable it to command a higher a PE.

It is important to understand that EPS is the more important variable here. If the company has a growing EPS, a high PE ratio may be justified.

PE ratio in isolation can hardly help you make a buy decision.

It needs to be combined with other metrics like growth rate of the company, the historical PE ratio, ROCE etc.

A good way of knowing if the PE ratio is justified is to compare with the stock’s historical PE ratio.

You can check the historical PE of the stock in sites like screener.in (India), Morningstar.ca (US stocks).

However, finding companies with low P/Es usually eliminates high growth companies, which should be evaluated using growth investing techniques.

PE ratio and growth rate

PE ratio in isolation is hardly worthwhile measure to evaluate a stock’s value.

It makes more sense to compare the PE ratio of the stock with the industry PE ratio or the growth rate of the company.

Pether Lynch, Fidelity Fund’s Most successful manager and author of best selling book- “One Up on Wall Street” says that PE ratio is fair if it is equal the growth rate of the company. (Click here for the best investing books)

In other words, if the PE Ratio is less than the growth rate in earnings, then it can be considered to be a discount. Similarly, stock may be considered expensive if its PE ratio is much more than the growth rate in earnings (say 2 times).

PE ratio and ROE

Generally a company with a high ROE is able to command a higher PE as it is able to generate higher returns on incremental capital and grow its EPS faster.

PE ratio vs Forward PE

By using the forecasted future earnings per share instead of trailing earnings, you can calculate the forward PE ratio which is an extension of the PE ratio,

This is based on the premise that it is more important to look at the future earnings while evaluating a stock, rather than its past EPS.

The Forward PE ratio uses the company’s future EPS to evaluate the current market price of the share.

However, one must exercise precaution while using forward PE as the analysts often tend to over-estimate the future earnings of stock.

Can PE ratio be negative?

PE ratio can be negative if the company is making a loss i.e. has a negative EPS.

Is PE ratio really a valuation measure?

As Warren Buffet mentions in his annual letter for year 2000, “Common yardsticks such as dividend yield, the ratio of price to earnings or to book value, and even growth rates have nothing to do with valuation except to the extent they provide clues to the amount and timing of cash flows into and from the business.”

Just look at the way the PE ratio is calculated using the market price, relative to the earnings.

The numerator market price is a subjective measure based on the moods of Mr. Market and the more important variable is the denominator i.e. EPS.

It reflects more on the investor’s perception of the company and not its valuation.

If you are looking for a long term investment, the growth and predictability of EPS is far more important than the PE ratio trend.

As Warrant Buffet says “In the long term, the stock’s price will follow the direction of its earnings”

Industry wise PE ratio

Just like stocks, Industries have different PE depending on the nature of the business and the earning potential.

Some industries have higher growth rates e.g. technology industry and therefore tend to command a higher PE.

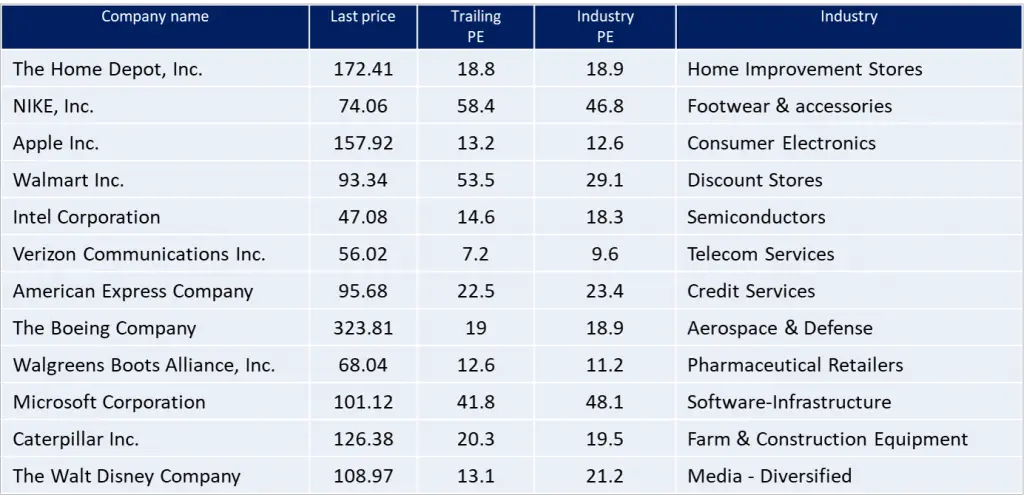

Let’s look at the stocks from the Dow jones index showing the PE ratio of 12 companies and their industry PE ratio:

Dow Jones Index- Data as on January 2, 2019

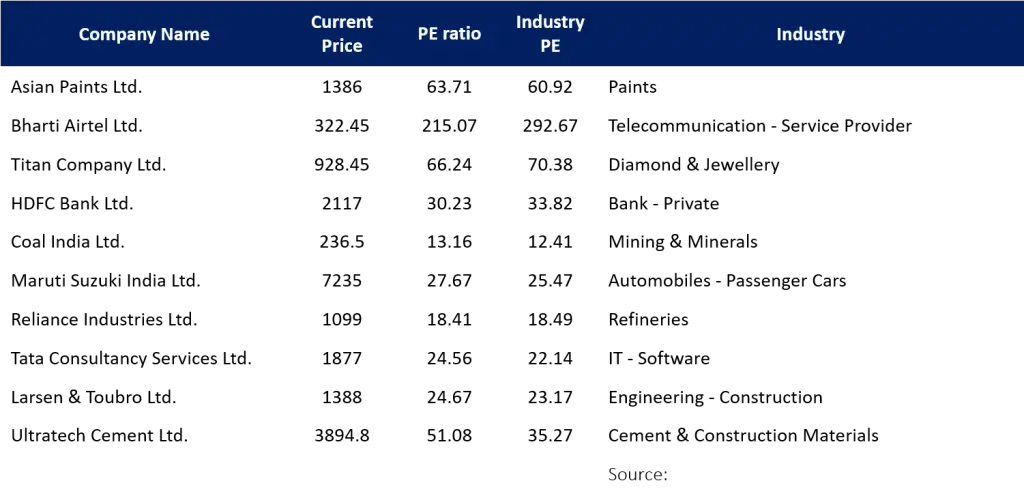

Nifty Index – Data as on January 4, 2019

As you can see, there is a lot of variation in the PE ratios and there is no standard PE which can be considered good or bad.

A low PE ratio is only good if you have looked at the other metrics and low price is either because the stock is yet to be popular or if it has run into a temporary road-block.

Moreover, the relevance of PE ratio in making an investment decision, also depends a lot on which industry the stock belongs to.

If you look at cyclical stocks like commodity based stocks i.e. steel, mining, oil & gas etc, here looking at the P/E ratios is hardly worthwhile.

Here, looking at the phase of the cycle is far more important than looking at the PE ratio.

In-fact a low PE ratio in cyclical stock may be a signal to avoid the stock.

A low PE ratio may result from the end of the cycle and is an indicator to avoid making an entry.

“Buying a cyclical after several years of record earnings and when the P/E ratio has hit a low point is a proven method for losing half your money in a short period of time.”‑ Peter Lynch

Similarly, in Banking Industry, the Price to Book Value ratio is more important to evaluate the stock than the PE.

William J. O’Neil the author of the book “How to make money in stocks” argues that a low P/E is probably because company’s past record is inferior.

He found higher the P/E stocks tend to perform better.

The conclusion we have reached from years of in-depth research into winning corporations is that the percentage increase and acceleration in earnings per share is more important than the level of the stock’s P/E ratio.

The average P/E of the best winners over the last fifteen years at the initial buy point prior to their huge price increases was 31 times earnings.

These P/Es went on to expand more than 100% to over 70 times earnings as the stocks significantly increased in price.

A high P/E stock with strong barriers to entry is a compounding machine, a highP/E stock without barriers to entry is a potential disaster-waiting to happen”- Basant Maheshwari

PE ratio expansion and contraction

When a low PE stock enters into an above average growth phase, it may bring about an increase in the PE ratio.

We call this phenomen as PE expansion or PE re-rating.

Note that during a bull phase, many stocks get a higher PE, which is caused by market euphoria and not by a change in the fundamentals of the stock.

This is when the stock becomes expensive if the high PE is not justified by the business.

The PE Expansion is based on the market’s anticipation of the future growth of the business and perception of sound business fundamentals of the business.

Here’s an interesting video where Warren Buffett explains the reason for higher PE ratios:

PE expansion backed by growth in EPS can bring you the multi-baggers.

A company trading at a higher PE may also see a drop in the PE when there is a change in the perception on the company’s growth fundamentals. This may be due to many factors like change in the industry trend, increase in competition, lack of innovation etc. This is called as P/E contraction.

P/E contraction backed by decreasing EPS can cause severe drop in the price of stock.

Since this is a double whammy where the fall in the investor perception impacts market price (the numerator) and declining EPS (denominator) makes the stock P/E ratio look even more expensive.

PE ratio drill- Key points to check

While considering PE ratio to make an investment decision, I perform the following checks:

- Compare the stock’s PE with the industry PE (Will prefer lower than industry PE unless justified)

- Compare the stock’s PE with its historical PE (usually last 5 years or more)

- Use the last three year’s average EPS to calculate the stock’s PE which is a more realistic measure than the trailing 12 month’s PE ratio. Benjamin Graham mentions that the PE ratio should not exceed 15 times the average earnings of the last three years.

- Compare the PE ratio with the growth rate in EPS i.e. Calculate price to growth ratio . Should be less than 1.

Hi, I am CA with a passion for personal finance and investing. I use this blog to share helpful money gyan that I have learned the hard way.