This post gives you all the information including 80GG calculator in excel to calculate the eligible deduction i.e. income tax benefit under Section 80GG for your rent payments.

You can get the tax benefit under section 80GG of Income Tax Act, 1961 if you are paying rent for your accommodation, but do not get House Rent Allowance (HRA) as a component of your salary.

This benefit is available to both salaried and self employed people. Pensioners who don’t receive HRA often take the benefit of 80GG.

However, there are certain conditions attached to this.

Let’s first look at all the conditions for getting 80GG deduction.

Eligibility- Conditions to be met for 80GG

To be eligible for 80GG tax benefits, you need to satisfy following conditions:

Condition 1: You have paid rent for your own residence

Condition 2: You have not received any HRA from your employer during the year

Condition 3: You, your spouse, minor child or the HUF (if any) of which you are a member – do not own residence at the place where you currently reside or perform office duties or conduct your business or profession.

Condition 4: If you own any residence at any other place (other than place of residence noted above), you do not claim tax benefit for this property as a self-occupied property.

The logic behind condition 4 is if you consider the above rental property (under point 3 ) as your place of residence, you cannot then show any other owned residential property as a self-occupied house property.

Maximum Limit for deduction under section 80GG

The maximum benefit that you can get under section 80GG, will be least of below amounts:

- Limit 1: Rs. 60,000 per year (i.e. Rs. 5,000 per month)

- Limit 2: Total rent paid minus 10% of the adjusted total income

- Limit 3: 25% of adjusted total income of employee

Where Adjusted Total Income = Gross Total Income – Short Term Capital Gain on sale of shares and mutual funds u/s 111A – Long Term Capital Gain – Deductions under section 80C to 80U (Excluding 80GG)

Since Short term capital gains u/s 111A and Long Term Capital Gains are not taxed as per slab and at a flat rate, they are deducted from Gross total income to arrive at Adjusted Total Income

80GG Calculator Excel Download

You can download the 80GG deduction calculator (below) which is an excel tool to help you calculate the amount of tax benefit available 80GG:

You need to enter the details of your rent paid, Long Term Capital Gains. Short Term Capital Gains and other deductions under section 80C to 80 U etc. to calculate the amount of eligible deduction.

Calculation Example 1

Let’s look at an example of 80GG benefit calculation.

Mr. A is residing in a rental accomodation at Kolkata for his job. He does not get HRA as a component of his salary. Also, he and his family members don’t own any residential accomodation at Kolkata.

Mr. A owns an accommodation at Delhi which he has given out on rent. Hence, he does claim self-occupied property benefit in his Income Tax Return.

Since A satisfies all the conditions for 80GG, he will be eligible for this tax benefit.

Now, let’s look at the maximum amount of benefit he can get, based on the following information:

Rent paid per month by A for property in Kolkata- Rs. 8,000/-

A’s Gross Total Income is Rs.7, 20,000/-

Long Term Capital Gain – Rs.95,000/-

Short Term Capital Gain on sale of shares, mutual funds- Rs.20,000/-

Deductions under section 80C to 80U (Excluding under 80GG) – Rs. 1,50,000/-

A’s Adjusted Total Income = 7,20,000-95,000-20,000-1,50,000= Rs.4,55,000/-

Maximum Deduction-

Limit 1: 5,000 per month i.e. Rs. 60,000

Limit 2: 25% of Adjusted Total Income : 4,55,000 * 25%= Rs. 1,13,750/-

Limit 3: Actual Rent – 10% of Adjusted Total Income= 8000 p.m x 12 months – 4,55,000* 10%= 96,000 – 45500= Rs.50,500/-

Maximum Deduction under Section 80GG = Least of above 3 limits i.e. Rs. 50,500/-

Calculation Example 2

Mr. B stays in a rental accomodation at Mumbai for his job. He does not get HRA as a component of his salary.

Mr.B owns a residential property in Delhi where his family stays. He has claimed benefit under section 24 as self occupied house property for this Delhi property.

Accordingly, Mr. B will not be eligible for getting benefit of deduction under section 80GG as he fails to satisfy Condition 4.

Calculation Example 3

Mr. C is residing in a rental accomodation at Gujarat for his job. He does not get HRA as a component of his salary. He does not own any other residential accomodation.

Since C satisfies all the conditions for 80GG, he will be eligible for this tax benefit.

For the year 2018-19, following are the details of the rent payments and income from capital gains for Mr.C:

Rent paid per month by A for property in Gujarat – Rs. 9,000/-

A’s Gross Total Income is Rs.6,54,000/-

Long Term Capital Gain – Rs.27,000/-

Short Term Capital Gain on sale of shares, mutual funds- Rs.14,000/-

Deductions under section 80C to 80U (Excluding under 80GG) – Rs. 1,50,000/-

A’s Adjusted Total Income = 6,54,000-27,000-14,000-1,50,000= Rs.4,63,000/-

Maximum Deduction-

Limit 1: 5,000 per month i.e. Rs. 60,000

Limit 2: 25% of Adjusted Total Income : 4,63,000 * 25%= Rs. 1,15,750/-

Limit 3: Actual Rent – 10% of Adjusted Total Income= 9000 p.m x 12 months – 4,63,000* 10%= 1,08,000 – 46,300= Rs.61,700/-

Maximum Deduction under Section 80GG = Least of above 3 limits i.e. Rs. 60,000/-

Calculation Example 4

Mr. M stays in a rental accomodation at Mumbai for his job. He does not get HRA as a component of his salary.

Mr. M’s spouse owns an ancestral residential property in Mumbai.

Accordingly, Mr. M will not be eligible for getting benefit of deduction under section 80GG as he fails to satisfy Condition 3.

What documents are required for claiming 80GG tax benefit?

Documents Required for 80GG claim:

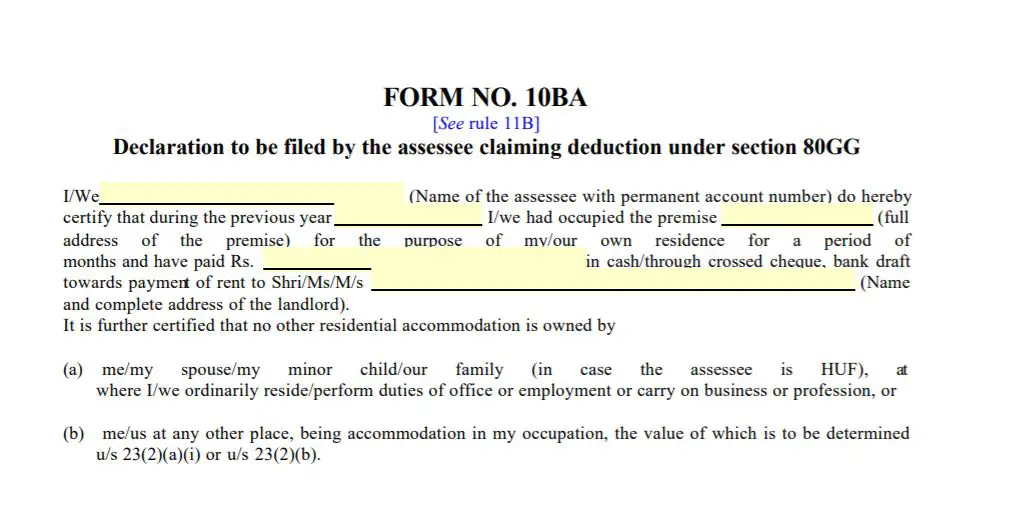

- A declaration under Form 10BA confirming that you are satisfying all conditions of 80GG

- Rent agreement and Rent receipts

- PAN of the landlord

You need to fill the following details in Form 10BA:

- Name and PAN of the assessee

- Full address of Rental premises

- Residency tenure in months

- Mode of payment- Cash / Cheque / Demand Draft

- Amount of rent paid

- Name and address of the landlord.

- Declaration confirming that no other residence owned by you or your Spouse / minor child or by the HUF (if any of which you are member) at your place of your residence

- Declaration that you are not claiming deduction for self occupied property at any other accomodation

80GG Bare Text as contained in Income Tax Act, 1961

80GG. In computing the total income of an assessee, not being an assessee having any income falling within clause (13A) of section 10, there shall be deducted any expenditure incurred by him in excess of ten per cent of his total income towards payment of rent (by whatever name called) in respect of any furnished or unfurnished accommodation occupied by him for the purposes of his own residence, to the extent to which such excess expenditure does not exceed 45[five] thousand rupees per month or twenty-five per cent of his total income for the year, whichever is less, and subject to such other conditions or limitations as may be prescribed46, having regard to the area or place in which such accommodation is situated and other relevant considerations :

Provided that nothing in this section shall apply to an assessee in any case where any residential accommodation is—

(i) owned by the assessee or by his spouse or minor child or, where such assessee is a member of a Hindu undivided family, by such family at the place where he ordinarily resides or performs duties of his office or employment or carries on his business or profession; or

(ii) owned by the assessee at any other place, being accommodation in the occupation of the assessee, the value of which is to be determined under clause (a) of sub-section (2) or, as the case may be, clause (a) of sub-section (4) of section 23.

Explanation.—In this section, the expressions “ten per cent of his total income” and “twenty-five per cent of his total income” shall mean ten per cent or twenty-five per cent, as the case may be, of the assessee’s total income before allowing deduction for any expenditure under this section.

Let us know if you have any questions and comments on the 80GG calculator.

References

Hi, I am CA with a passion for personal finance and investing. I use this blog to share helpful money gyan that I have learned the hard way.